Youth Unleashed

Exploring the vibrant voices and trends shaping the youth culture today.

Disability Insurance: The Safety Net You Didn't Know You Needed

Discover the hidden benefits of disability insurance—your essential safety net for financial security when life takes an unexpected turn!

Understanding Disability Insurance: Why It's Essential for Your Financial Security

Disability insurance is a crucial component of financial planning that provides a safety net in the event that you become unable to work due to illness or injury. Unlike health insurance, which covers medical expenses, disability insurance offers wage replacement, ensuring that you can maintain your standard of living. With statistics showing that approximately 1 in 4 of today's 20-year-olds will experience a disability before reaching retirement age, having this form of insurance can be fundamental for economic stability.

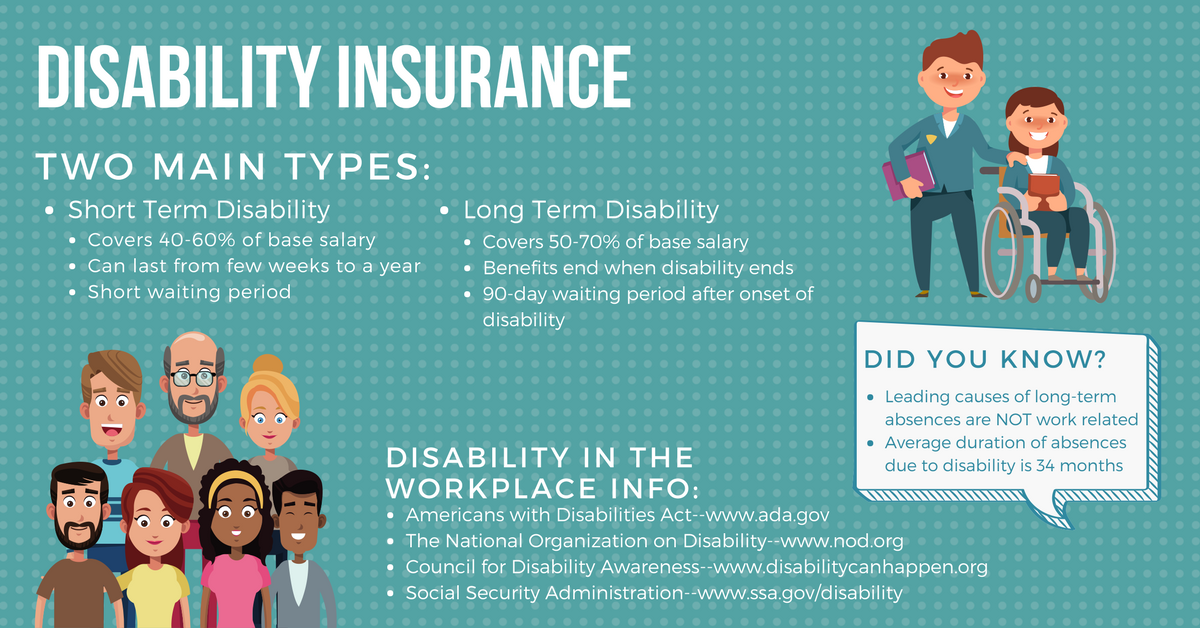

Understanding the different types of disability insurance—such as short-term and long-term options—can help you make informed decisions tailored to your individual needs. Short-term policies typically cover a portion of your salary for a few months to a couple of years, while long-term plans can extend benefits for several years or until retirement age. Implementing a disability insurance policy not only equips you with financial security but also grants peace of mind, allowing you to focus on recovery without the added stress of financial uncertainty.

Top 5 Myths About Disability Insurance Debunked

Disability insurance is often surrounded by misconceptions that can lead to confusion and misinformation. One of the most prevalent myths is that disability insurance is only for those in high-risk professions. In reality, injuries and illnesses can affect anyone, regardless of their job. According to studies, nearly one in four people will experience a disability lasting longer than 90 days at some point in their lives. This highlights the importance of having disability insurance as a safety net for all workers, not just those in physically demanding jobs.

Another myth is that disability insurance will cover all of your income if you become unable to work. In most cases, disability policies provide a percentage of your income, typically around 60-70%, rather than a full replacement. It's essential to understand the specifics of your policy and how it calculates benefits. Many people also believe that they are automatically covered by their employer's plan, but not all employers provide comprehensive coverage. Therefore, it's crucial to evaluate your needs and consider purchasing an individual policy for additional protection.

Do You Really Need Disability Insurance? Key Questions to Consider

When considering whether disability insurance is necessary for you, it's essential to evaluate your personal situation. Ask yourself how financially dependent you are on your income. If you play a critical role in supporting your family, losing your income due to a disability could lead to significant hardships. Additionally, consider how long your savings would last if you were unable to work. A common rule of thumb is to have enough savings to cover at least three to six months of living expenses, but if you have a longer recovery period, disability insurance may be crucial.

Another important question to ponder is your occupation and health status. Certain jobs come with a higher risk of injury, and individuals in these occupations may benefit from disability insurance more than others. Moreover, if you have pre-existing health conditions, you might be more susceptible to disabilities that could prevent you from working. Analyzing your job security, the likelihood of job loss due to disability, and the benefits provided by your employer can help determine if purchasing a policy is the right choice for you.