Youth Unleashed

Exploring the vibrant voices and trends shaping the youth culture today.

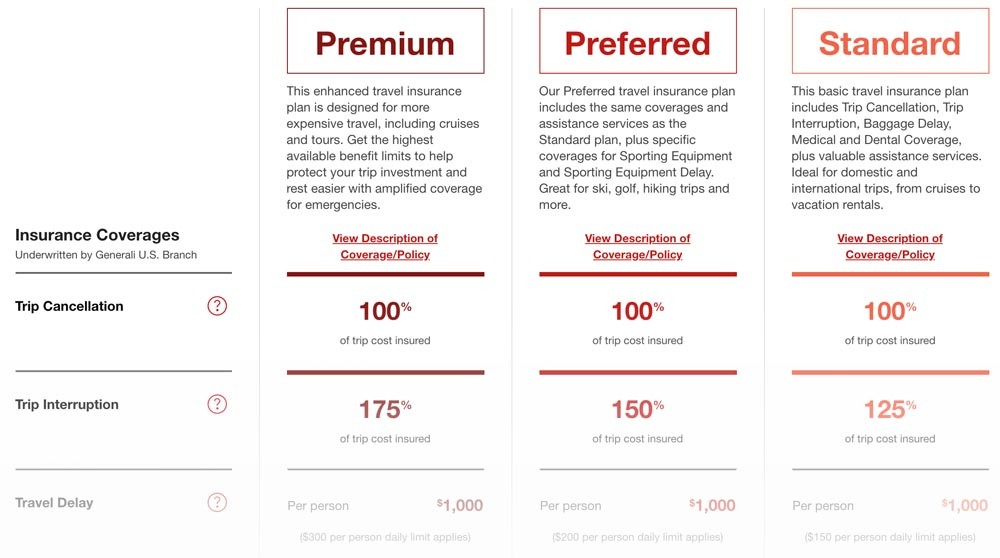

Insurance Showdown: Battle of the Policies

Discover the ultimate face-off in Insurance Showdown! Find out which policy reigns supreme and unlock the best coverage for your needs.

Understanding the Key Differences: Term Life vs. Whole Life Insurance

Term life insurance and whole life insurance are two popular types of life insurance that serve different purposes. Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years, and is designed to protect your loved ones financially in the event of your death during that term. Premiums for term policies are generally lower compared to whole life policies, making them an attractive option for individuals seeking affordable coverage. However, once the term ends, coverage ceases, and there is no cash value accumulation, meaning that if you outlive the policy, you won’t receive any benefits.

On the other hand, whole life insurance offers lifelong coverage and includes a cash value component that grows over time. Unlike term life, this policy remains in effect as long as premiums are paid, ensuring that your beneficiaries will receive a death benefit whenever you pass away. The premiums for whole life insurance are higher than those for term life, but they provide the advantage of a savings element that can be accessed during your lifetime. This makes whole life a suitable choice for those who want both insurance coverage and a long-term investment strategy.

What to Know Before You Buy: A Comprehensive Guide to Health Insurance Policies

When considering health insurance policies, it’s essential to understand the various types available. Typically, you’ll encounter managed care plans, such as Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs), which differ in terms of flexibility and costs. Additionally, assess other factors including premium costs, deductibles, copayments, and maximum out-of-pocket expenses to identify a plan that fits your financial situation. Evaluate your healthcare needs and consult with health professionals to ensure you’re adequately covered for necessary services.

Before making a final decision, take the time to read the fine print of any potential health insurance policy. Look for crucial details such as policy exclusions, waiting periods, and the process for filing claims. Research the provider network to ensure your preferred doctors and hospitals are included. Consider contacting customer service for any clarity on confusing terms or conditions. A well-informed choice can mean the difference between good coverage and unexpected out-of-pocket expenses, so never rush the process.

Homeowners Insurance vs. Renters Insurance: Which One is Right for You?

When considering homeowners insurance versus renters insurance, it's essential to understand the fundamental differences between the two. Homeowners insurance typically covers the structure of your home, your personal belongings, and liability for injuries that occur on your property. This type of insurance is ideal for those who own their homes and wish to protect their investment. In contrast, renters insurance is designed specifically for tenants. It protects personal belongings within a rented property and provides liability coverage, but does not cover the physical structure itself.

To determine which insurance is right for you, assess your situation by asking yourself some key questions:

- Do you own or rent your property?

- What is the value of your personal belongings?

- Do you want protection for liability in case someone gets injured in your home?